| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 240.14a-12 | |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11. | |||

Notice of 2024 Annual Meeting of Shareholders

To Our Shareholders:

Notice is hereby given that the 20222024 Annual Meeting of Shareholders (the “Annual Meeting”) of Regency Centers Corporation will be held virtually, via live webcast,exclusively online at www.virtualshareholdermeeting.com/REG2022REG2024 on Friday, April 29, 2022,Wednesday, May 1, 2024, beginning at 8:00 A.M., Eastern Time. You will be able to attend the Annual Meeting online and submit questions during the meeting by visiting the above website and following the instructions.

The meeting will be held for the following purposes:

| 1. | To elect as directors the 11 nominees named in the attached proxy statement, to serve until the |

| 2. | To approve, in a non-binding vote, an advisory resolution approving the company’s executive compensation for fiscal year |

| 3. | To ratify the appointment of KPMG LLP as |

| 4. | To transact such other business as may properly come before the meeting or any |

The accompanying proxy statement more fully describes these matters.

Shareholders of record at the close of business on March 10, 20228, 2024 will be entitled to vote and participate innotice of the Annual Meeting.

Please be aware that if you own shares in a brokerage account, you must instruct your broker how to vote your shares. Nasdaq Stock Market rules do not allow your broker to vote your shares without your instructions onMeeting and any of the above proposals except the ratification of the appointment of the Company’s independent registered public accounting firm. Please exercise your right as a shareholderadjournments or postponements thereof, and to vote on all proposals, including the election of directors, by instructing your broker by proxy.matters above.

The Annual Meeting will be virtual-only, held exclusively online. The platform for the virtual Annual Meeting includes functionality that affords authenticated shareholders comparable meeting participation rights and opportunities as they would have at an in-person meeting. Instructions to access and log-in to the virtual Annual Meeting are provided under “What are the procedures for attending and participating in the virtual Annual Meeting?” on page 56 in the accompanying proxy statement.

By Order of the Board of Directors,

Michael R. Herman

Senior Vice President,

General Counsel and Secretary

Dated: March 18, 202220, 2024

20222024 ANNUAL MEETING INFORMATION:

| DATE: | ||

| TIME: | 8:00 A.M., Eastern Time | |

The Annual Meeting will be held in a virtual-only format and will be available via live webcastexclusively online at www.virtualshareholdermeeting.com/REG2022REG2024.

To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or on the instructions that accompany your proxy materials. For further information on your participation in the virtual Annual Meeting, please refer to the “Frequently Asked Questions Regarding Our Annual Meeting” on page 53.

HOW TO VOTE:

Your vote is important. You are eligible to vote if you were a shareholder of record at the close of business on March 10, 2022.8, 2024.

HOW TO VOTE:

Your vote is important. Even if you plan to attend the virtual Annual Meeting, we encourage you to vote your shares before the meeting to ensure they are counted. Shareholders of record have until 11:59 P.M, Eastern Time on April 30, 2024 to vote.

| BY INTERNET PRIOR TO MEETING www.proxyvote.com | |

BY INTERNET DURING MEETING www.virtualshareholdermeeting.com/ | ||

| BY PHONE PRIOR TO MEETING Call 1.800.690.6903

| |

| BY MAIL PRIOR TO MEETING Complete, sign and return | |

OnTo vote or about March 18, 2022, we will mail to our shareholders of recordparticipate in the virtual meeting, you must have the control number that appears on March 10, 2022 who have not previously requested to receive these materials by mail or e-mail ayour Notice of Internet Availability of Proxy Materials which contains instructionsor proxy card.

Our Board of Directors is soliciting proxies to be voted at the Annual Meeting on how to accessMay 1, 2024 and at any adjournments or postponements thereof. We expect that this proxy statement and our annual reportform of proxy will be mailed and vote online. The Notice instructs you asmade available to how you may access and review allshareholders beginning on or about March 20, 2024.

Important notice regarding the availability of the important information contained in the proxy materials. The Notice also instructs you how to submit your proxy on the Internet or by telephone. If you received the Notice by mail, you will not automatically receive a printed copy of our proxy materials or annual report unless you followfor the instructionsAnnual Meeting of Shareholders to be held on Wednesday, May 1, 2024: The Proxy Statement for requesting these materials included in the Notice.2024 Annual Meeting of Shareholders and 2023 Annual Report to Shareholders are available at: https://investors.regencycenters.com.

REGENCY CENTERS | 2022 2024 PROXY STATEMENT |i

| Table of Contents

| i | ||||

| 1 | ||||

| 8 | ||||

| 8 | ||||

| 9 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 17 | ||||

| 18 | ||||

| 19 | ||||

| 23 | ||||

| 24 | ||||

| 25 | |||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 28 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 31 | ||||

| 31 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| ||||

| ||||

| 50 | ||||

| 51 | ||||

| 52 | |||

| 53 | ||||

| 54 | ||||

Shareholder Proposals and Communications with the Board of Directors | ||||

Appendix A — Definitions and Reconciliations of GAAP and Non-GAAP Financial Measures | A-1 | |||

ii| REGENCY CENTERS | 2022 2024 PROXY STATEMENT

Table of Contents |

Forward-Looking Statements

Certain statements in this document regarding anticipated financial, business, legal or other outcomes, including business and market conditions, outlook and other similar statements relating to Regency’s future events, developments, or financial or operational performance or results, are “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements are identified by the use of words such as “may,” “will,” “could,” “should,” “would,” “expect,” “estimate,” “believe,” “intend,” “forecast,” “project,” “plan,” “anticipate,” “guidance,” and other similar language. However, the absence of these or similar words or expressions does not mean a statement is not forward-looking. While we believe these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements. Although we believe the expectations reflected in any forward-looking statements are based on reasonable assumptions, we can give no assurance these expectations will be attained, and it is possible actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Forward-looking statements are only as of the date they are made, and Regency undertakes no duty to update its forward-looking statements except as required by law.

Our operations are subject to a number of risks and uncertainties including, but not limited to, those risk factors described in Item 1A of our SEC filings.2023 Annual Report on Form 10-K, which has been filed with the Securities and Exchange Commission (“SEC”). When considering an investment in our securities, you should carefully read and consider these risks, together with all other information in our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and our other filings with and submissions to the SEC. If any of the events described in the risk factors actually occur, our business, financial condition or operating results, as well as the market price of our securities, could be materially adversely affected. Forward-looking statements are only provided as of the date they are made, and Regency undertakes no duty to update its forward-looking statements, whether as a result of new information, future events or developments or otherwise, except as and to the extent required by law.

REGENCY CENTERS | 2022 2024 PROXY STATEMENT |iii

|

HereIn this proxy statement, the terms “we,” “our,” “us,” “the Company,” “Regency Centers,” and “Regency” refer to Regency Centers Corporation. In this proxy summary, we present an overview of information that you will find throughout this proxy statement. As this is only a summary, we strongly encourage you to read the entire proxy statement for more information about these topics prior to voting.

Voting Matters

The following table summarizes the proposals to be voted on prior to or at our 2024 Annual Meeting of Shareholders of Regency Centers and the Board’s voting recommendations of our Board of Directors (“Board”) with respect to each proposal.

PROPOSAL | BOARD’S VOTING RECOMMENDATION | PAGE REFERENCE | ||||||

Proposal 1: Election of our Board’s 11 | FOR | 8 | ||||||

Proposal 2: Advisory | FOR | 25 | ||||||

Proposal 3: Ratification of | FOR | 52 | ||||||

About Regency Centers

Regency Centers is a preeminent national owner, operator and developer of neighborhood and community shopping centers predominantly located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers and best-in-class retailers that connect to their neighborhoods, communities and customers. Operating as a fully integrated real estate company, Regency Centers is a qualified real estate investment trust (REIT) that is self-administered, self-managed and an S&Pa Standard & Poor’s (S&P) 500 Index member.

Our Core Values

At Regency Centers, we have lived our valuesCore Values for nearlymore than 60 years by successfully meeting our commitments to our people, our customers, our communities and our shareholders. We hold ourselves to this high standard every day. We believe our exceptional culture will continue to set usRegency apart into the future through our unendingunwavering dedication to these beliefs:

REGENCY CENTERS | 2022 2024 PROXY STATEMENT |1

| Proxy Summary

LONGSTANDING EXCELLENCE IN OPERATIONAL PERFORMANCE AND FINANCIAL MANAGEMENTExcellence in Operational Performance

and Financial Management

Regency Centers has demonstrated superior operational performance and createdcontinues to generate value for our shareholders due tothrough our exceptional operational performance, high-quality portfolio, strong balance sheet, superior asset management and development capabilities, and an exceptionala talented team located across 22more than 20 offices nationwide. Our conservative leverage and disciplined approach to capital allocation allow us to effectively operate, acquire and develop properties throughout the business cycle. During 2021,2023, our teams wereteam was able to pursue and execute on value-add leasing transactions, acquisitionsmerger and acquisition opportunities, and development and redevelopment projects that willto further enhance our high-qualitysector-leading portfolio of over 400480 properties in top trade areas around the country.

20212023 Business Highlights

| Operational |

| ◾ | Executed |

| ◾ |

| ◾ |

| ◾ |

|

| ◾ |

| ◾ |

| ◾ |

|

| Maintained S&P and Moody’s investment grade credit ratings of BBB+ and Baa1, respectively, and in February 2024, Moody’s upgraded the Company’s credit rating to A3 with a stable outlook |

|

| ◾ |

| ◾ |

| ◾ | Acquired high-quality shopping centers totaling over $60 million |

| Dividend Growth & Free Cash Flow |

| ◾ | Generated significant free cash flow after dividend and capital expenditures |

| ◾ | Increased our quarterly common stock dividend by 3% in 4Q23 to $0.67 per share |

| ◾ | Dividend CAGR (compound annual growth rate) of |

2020 & 2021(1) On January 18, 2024, the Company and its operating partnership, Regency Centers, L.P., entered into an amended and restated credit agreement, which provides an unsecured revolving credit facility in the amount of $1.5 billion. This new credit agreement terminates in March of 2028.

(2) Adjusted Trailing 12-Month Net Debt-to-Operating EBITDAre(3) calculation includes legacy Regency results for the trailing 12 months as of December 31, 2023 and the annualized contribution from properties acquired in the merger with Urstadt Biddle Properties Inc. on August 18, 2023.

(3) See Appendix A for reconciliations of GAAP to non-GAAP measures.

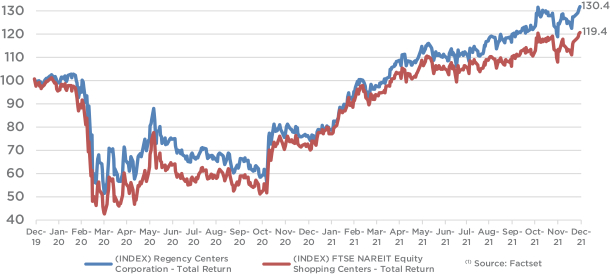

10-Year Total Shareholder Return(1) (2014 – 2023)

Regency Outperformed Peers by 11%52%

2| REGENCY CENTERS | 2022 2024 PROXY STATEMENT

Proxy Summary |

EXCELLENCE IN CORPORATE GOVERNANCEExcellence in Corporate Governance

Corporate Governance Highlights

Our Board and senior management are committed to best-in-class corporate governance. Following are highlightssome of our keymost important governance practices and policies:

Board Structure | ✓ Separate roles of Chairman of the Board (Chairman) and

✓

✓ 9 of 11 nominated directors are independent; Audit, Compensation, and Nominating and Governance Committees each entirely comprised of independent directors

✓ Executive sessions of independent directors held at every regular Board and

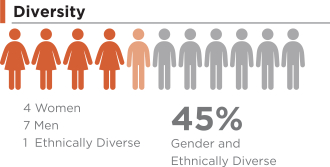

✓ Diverse Board with

✓ No familial relationships among Board members

✓ Limits on other board service to prevent “overboarding”

✓ Mandatory director retirement age of 75 years | |

Shareholder | ✓ Annual election of directors

✓ Majority voting for directors

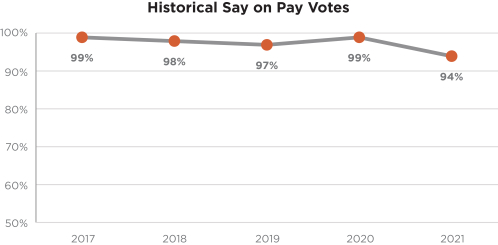

✓ Annual

✓

✓ Shareholders representing

✓ Proxy access: shareholders owning 3% of our common stock for at least 3 years may nominate up to 25% of board members

✓ No “poison pill” in effect | |

Board | ✓ Structured oversight of the Company’s corporate strategy and risk management allocated among full Board and Committees

✓ ✓ Robust Board and ✓ Annual self-assessment of Board and Board committee performance ✓ Ethics and compliance program oversight by Nominating and Governance Committee

✓

✓

✓ Code of Business Conduct and Ethics applicable to all directors, officers and employees | |

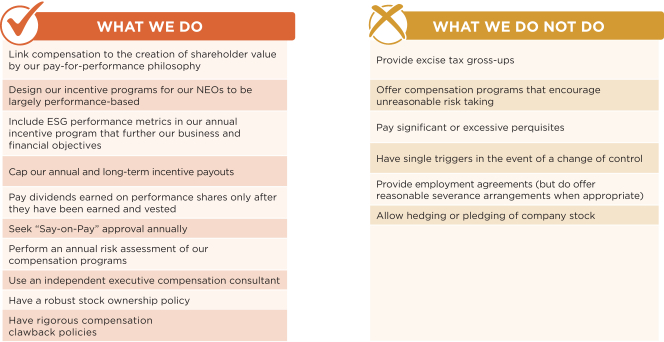

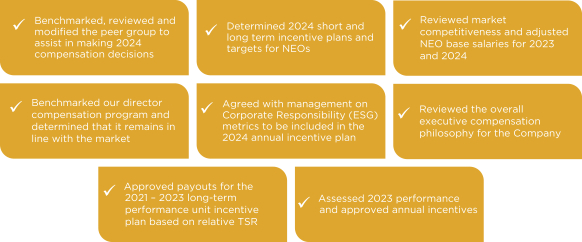

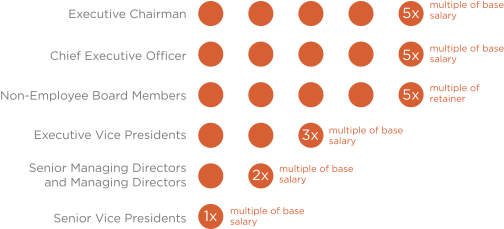

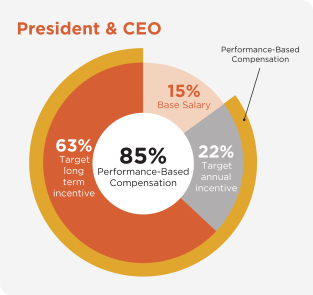

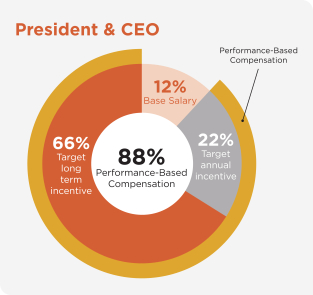

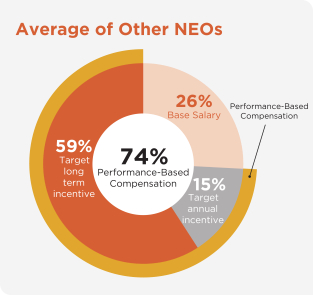

Executive Compensation | ✓ Annual incentives for

✓ Long-term incentives for NEOs largely based on relative total shareholder return (TSR), to foster alignment with shareholders

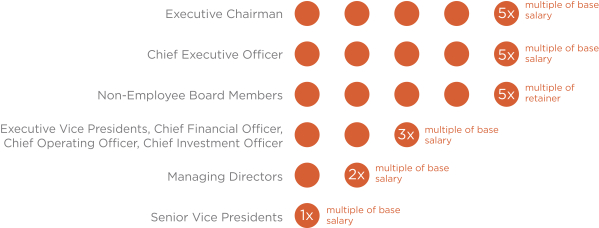

✓ Stock ownership policy for directors and senior management

✓ Prohibition of hedging and pledging Company stock by officers and directors

✓ Annual risk assessment of executive compensation programs

✓ Clawback

| |

REGENCY CENTERS | 2022 2024 PROXY STATEMENT |3

| Proxy Summary

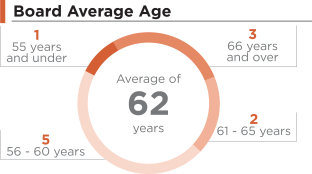

Our Board of Directors at a Glance

Below is an overview of some of the key attributes of our eleven nominees tofor election as director at the Board.2024 Annual Meeting of Shareholders. Additional information can be found in the skills matrix, Board diversity matrix and biographies for each Board member under Proposal One: Election of Directors.

|  |

|  |

|

|

|

|

* Does not include one director who joined the Board as part of the 2017 Equity One merger and resigned shortly thereafter.

4| REGENCY CENTERS | 2022 2024 PROXY STATEMENT

Proxy Summary |

EXCELLENCE IN CORPORATE RESPONSIBILITYExcellence in Corporate Responsibility

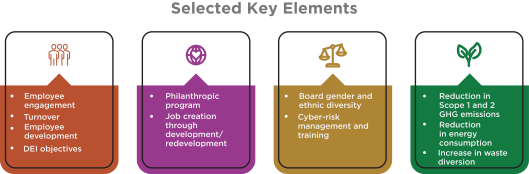

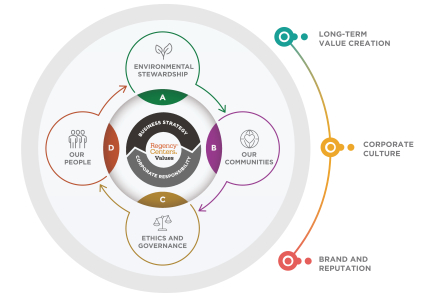

Regency’s values,Core Values, including the critical importance that we place on corporate responsibility,Corporate Responsibility (which we also refer to as ESG), are at the foundation of who we are and what we do. These values drive usWe believe that acting responsibly is strategic to implement leading ESG initiatives throughvalue creation for our corporate responsibility program.investors, the long-term sustainability of our business, the interests of our stakeholders, and the protection of the environment. Our Corporate Responsibility program is built on four pillarspillars—our people, our communities, ethics and governance, and environmental stewardship—and is guided by our focus on three overarching concepts: long-term value creation, Regency’s brand recognition and reputation, and the importance of maintaining our unique culture.culture, and Regency’s brand and reputation.

ESGOur Corporate Responsibility Pillars

Corporate Responsibility Oversight and Alignment with Business Strategy

|  |

Our Four Pillars of Corporate Responsibility

(ESG) strategy, initiatives, and business alignment, and has delegated to our Nominating and Governance Committee oversight of Regency’s ESG program and objectives. Our People: Our people areCorporate Responsibility Committee is comprised of senior leaders from key areas of our business and is tasked with working with management’s Executive Committee (which is made up of the Company’s four most important asset, and we strivesenior officers) to ensure that theyour ESG strategy and near-and long-term objectives are engaged, passionate about their work, connected to their teams, and supported to deliver their best performance. Regency recognizes and values the importance of attracting and retaining talented individuals with different skills, backgrounds and experiences. We strive to maintain a safe and healthy workspace, promote employee well-being, and empower our employees by focusing on their training and education. We continue to advance diversity, equity and inclusion (“DEI”)embedded throughout our organization by focusingbusiness decisions, processes, and activities for the benefit of our shareholders and key stakeholders important to our business success. Our President and CEO, Lisa Palmer, has ultimate senior management responsibility for our ESG program, through her oversight of our Corporate Responsibility Committee and the leadership of our Executive Committee.

In 2023, the Board’s Nominating and Governance Committee, and our full Board, were briefed regularly on four key areas: Talent, Culture, Marketplaceour Corporate Responsibility (ESG) program and Communities.objectives, including strategic sustainability and employee and community engagement initiatives, performance against metrics and targets, sustainability reporting, and the evolving landscape of ESG expectations and practices among our investors and other stakeholders.

Ethics and Governance: As long-term stewards of our investors’ capital, we are committed to best-in-class corporate governance. To create long-term value for our stakeholders, we place great emphasis on our culture and core values, the integrity and transparency of our reporting practices, and our overall governance structure in respect of oversight and shareholder rights.

| Proxy Summary

REGENCY CENTERS | 2022 PROXY STATEMENT |5

| Proxy SummaryCorporate Responsibility Highlights

Our Communities: Our predominately grocery-anchored neighborhood centers provide many benefits to the communities in which we invest and operate, including significant local economic impacts in the form of capital improvements, jobs and taxes. Our local teams are passionate about supporting and engaging with our communities. They customize and cultivate our centers to create a unique environment to bring our tenants and shoppers together for the best retail experience. Further, philanthropy and giving back are cornerstones of what we do and who Regency is. Charitable contributions are made directly by the Company, and the vast majority of our employees donate their time and money to local non-profits serving their communities.

Environmental Stewardship: We believe sustainability is in the best interest of our investors, tenants, employees and the communities in which we operate, and we strive to integrate sustainable practices throughout our business. We have six strategic priorities focused on sustainable business practices and minimizing our environmental impact:

We believe these six strategic priorities are the right areas of focus to address air pollution, climate change and resource scarcity, and support our business in achieving key strategic objectives in our operations and development projects.

Our Approach to ESGCorporate Responsibility Reporting and Disclosure

With a growing demand for disclosure from manyour shareholders and other stakeholders, including our investors, Regency remains committed to robust ESG-relatedCorporate Responsibility (ESG)-related disclosure that is transparent and systematic. We routinely engage with our investors and ESG rating organizations and investors to better understand their expectations and reflect on their priorities in considering and determining our planning and disclosure. In June 2021,May 2023, we issued our fourthsixth annual Corporate Responsibility Report, and, in January 2022, we issued our second standalone Task Force on Climate-Related Financial Disclosures (TCFD) Report. Our most recent Corporate Responsibility Report was prepared in accordance with the Global Reporting Initiative (GRI)(“GRI”) standard and aligned with the UNUnited Nations Sustainable Development Goals, (UNSDG), Sustainability Accounting Standards Board (SASB)(“SASB”) and TCFD frameworks. Additionally, available on our website, is our most recent EEO-1 survey. To access our Corporate Responsibility and TCFD reports,Report, along with our other corporate responsibility reports and policies, including our strategy, goals, quantitative metrics and performance, visit our website at https://www.regencycenters.com/corporate-responsibility.

The content on our website, including our Corporate Responsibility and TCFD reports and other information related to corporate responsibility, is not incorporated by reference into this proxy statement or any other report or document we file with the SEC, and any references to our website are intended to be inactive textual references only.

6| REGENCY CENTERS | 2022 2024 PROXY STATEMENT

Proxy Summary |

EXCELLENCE IN STAKEHOLDER ENGAGEMENTExcellence in Stakeholder Engagement

Our year-round active engagement with a wide variety ofour stakeholders enablessupports and enhances our success in owning, operating, developingas a preeminent national owner, operator and generating value from our national portfoliodeveloper of predominantly grocery-anchored shopping centers. Throughout the COVID-19 pandemic, our teams have continued to place a priority on safe and continuous engagement.centers located in suburban trade areas with compelling demographics.

Stakeholder Group | Engagement Approach | Topics of Discussion | ||||

|

Shareholders, Bondholders & Lenders |

◾ Transparent information sharing throughout the year via company filings, ◾

◾ In 2023, actively communicated with shareholders representing approximately 74% of our common stock ownership ◾ One-on-one and group meetings, calls, property tours and Regency-hosted events ◾ Interactions facilitated via industry associations and

| ✓Company performance ✓ Strategic goals and ✓ Transparent disclosure ✓ Corporate governance ✓ Corporate Responsibility initiatives | |||

|

Employees |

◾

◾ Goal setting by each employee with their managers ◾ Direct dialogue through employee review meetings, company-wide town hall meetings and ◾ Employee task forces and focus groups on Corporate Responsibility initiatives and actions, including employee resource groups ◾ Formal third-party reporting mechanisms to raise any | ✓ Employee engagement, productivity, health and ✓ Corporate Responsibility initiatives ✓ Benefits and ✓ Career development and training | |||

|

Partners |

◾ Dedicated ◾ Proactive and regular one-on-one dialogue ◾ Property tours, monthly financial calls and quarterly |

✓Property and joint venture performance and | |||

|

Tenants |

◾ Extensive tenant resources ◾ Website with best-in-class marketing resources for the ◾

◾ Targeted application of our Merchandising, Placemaking and Connecting strategies and initiatives across all properties and on a tenant-by-tenant basis |

✓Tenant ✓ Property maintenance ✓ Improving tenant flexibility and ✓ Health and ✓ Sustainable building practices | |||

|

Communities | ◾ One-on-onedialogue with local and regional planning agencies, municipal boards, permitting authorities and community groups ◾ Direct dialogue through open houses and town halls ◾ |

✓Project-specific ✓ Community interests and ✓ Curated merchandising and | |||

REGENCY CENTERS | 2022 2024 PROXY STATEMENT |7

| Proposal One: Election Of Directors

Proposal One: Election Of Directors

Our Restated Articles of Incorporation, as amended, provide for the number of directors to be fixed pursuant to our bylaws, subject to a minimum of three and a maximum of fifteen. As of the date of this proxy statement, our Board has twelveeleven directors. All nominees were elected as directors by our shareholders at the 2021 annual meeting with the exception of James H. Simmons, III, who was added to the Board after the 2021 annual meeting. Joseph F. Azrack will not stand for re-election this year, as he will have reached the mandatory retirement age of 75 pursuant to our Corporate Governance Guidelines; all other directors have been nominated to stand for re-election at the 2022 annual meeting. The Board will consist ofCompany’s 2023 Annual Meeting. All eleven directors after the 2022 annual meeting. All directors elected at the meetingour 2024 Annual Meeting will serve until the 2023 annual meetingour 2025 Annual Meeting and until their successors are elected and qualified.

The accompanying proxy card will be voted for the election of each of the Board’s eleven nominees, unless a shareholder directsit includes instructions otherwise. Each nominee is presently availablehas consented to stand for election. If any nominee should become unavailable, which iswe do not currently anticipated, the persons voting the accompanying proxyanticipate, proxies instructing a vote for that nominee may votebe voted for a substitute nominee designatedselected by our Board of Directors or, alternatively, our Board may determine to leave the vacancy temporarily unfilled or reduce the size of the Board and number of nominees.directors in accordance with our bylaws.

Information about each of the nominees, including biographies, is set forth below and on the following pages.

|

You are being asked to vote on the election of the eleven director nominees listed below. Directors are elected by a majority of votes cast. Each nominee ishas been determined to be independent, in accordance with applicable Nasdaq Stock Market listing requirements, except for Mr. Stein (Executive Chairman) and Ms. Palmer (President and CEO). Upon election of these Directorsdirectors at the Annual Meeting, the Directorsdirectors shall hold the Board committee memberships and chair positions as follows:

Committee Membership

| |||||||||||||||||||||||||||||||||

Committee Membership

| |||||||||||||||||||||||||||||||||

Name and Primary Occupation | Age | Director Since | Audit | Compensation | Nominating and Governance | Investment | Age | Director Since | Audit | Compensation | Nominating and Governance | Investment | |||||||||||||||||||||

Bryce Blair Chairman of PulteGroup, Inc. and Principal of Harborview Associates, LLC |

| 63 |

| 2014 | 🌑 | ¶ | |||||||||||||||||||||||||||

Bryce Blair Principal of Harborview Associates, LLC |

| 65 | 2014 | 🌑 | ¶ | ||||||||||||||||||||||||||||

C. Ronald Blankenship Lead Director of the Board and Director of Civeo Corporation |

| 72 |

| 2001 | 🌑 | 🌑 |

| 74 | 2001 | 🌑 | 🌑 | ||||||||||||||||||||||

Deirdre J. Evens Executive Vice President and General Manager, IT Asset Lifecycle Management of Iron Mountain |

| 58 |

| 2018 | 🌑 | ¶ | |||||||||||||||||||||||||||

Kristin A. Campbell Recently Retired Executive Vice President, General Counsel and Chief ESG Officer of Hilton Worldwide Holdings Inc. |

| 62 | 2023 | 🌑 | 🌑 | ||||||||||||||||||||||||||||

Deirdre J. Evens Recently Retired Executive Vice President and General Manager, IT Asset Lifecycle Management of Iron Mountain |

| 60 | 2018 | 🌑 | ¶ | ||||||||||||||||||||||||||||

Thomas W. Furphy Chief Executive Officer and Managing Director of Consumer Equity Partners |

| 55 |

| 2019 | 🌑 | 🌑 |

| 57 | 2019 | 🌑 | 🌑 | ||||||||||||||||||||||

Karin M. Klein Founding Partner of Bloomberg Beta |

| 50 |

| 2019 | 🌑 | 🌑 |

| 52 | 2019 | ¶ | 🌑 | ||||||||||||||||||||||

Peter D. Linneman Principal of Linneman Associates |

| 70 |

| 2017 | 🌑 | 🌑 |

| 72 | 2017 | 🌑 | 🌑 | ||||||||||||||||||||||

David P. O’Connor Managing Partner of High Rise Capital Partners, LLC |

| 57 |

| 2011 | 🌑 | ¶ |

| 59 | 2011 | 🌑 | ¶ | ||||||||||||||||||||||

Lisa Palmer President and Chief Executive Officer of Regency Centers Corporation |

| 54 |

| 2018 | 🌑 |

| 56 | 2018 | 🌑 | ||||||||||||||||||||||||

James H. Simmons, III Chief Executive Officer and Founding Partner of Asland Capital Partners |

| 55 |

| 2021 | 🌑 | 🌑 |

| 57 | 2021 | 🌑 | 🌑 | ||||||||||||||||||||||

Martin E. Stein, Jr. Executive Chairman of the Board and Former Chief Executive Officer of Regency Centers Corporation |

| 69 |

| 1993 | 🌑 | ||||||||||||||||||||||||||||

Thomas G. Wattles Former Chairman of DCT Industrial Trust |

| 70 |

| 2001 | ¶ | 🌑 | |||||||||||||||||||||||||||

Martin E. Stein, Jr. Executive Chairman of the Board and Retired Chief Executive Officer of Regency Centers Corporation |

| 71 | 1993 | 🌑 | |||||||||||||||||||||||||||||

🌑 Member ¶ Committee Chair  Audit Committee Financial Expert

Audit Committee Financial Expert

8| REGENCY CENTERS | 2022 2024 PROXY STATEMENT

Proposal One: Election Of Directors |

Director NomineesNominee Qualifications

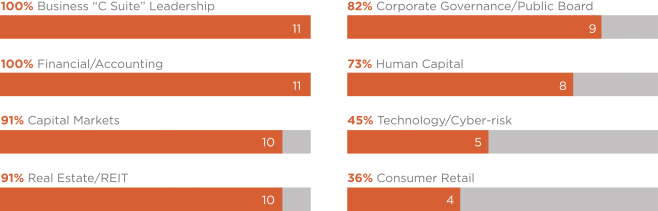

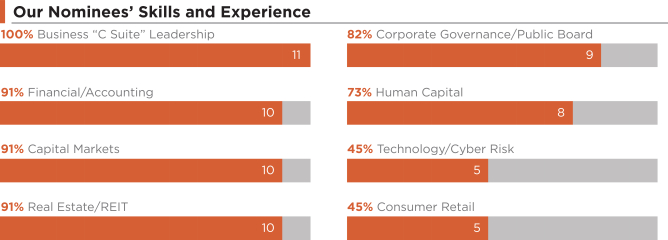

The following skills matrix and biographies of our nominees contain information regarding each person’s qualifications, experience, self-identification, other director positions held currently or at any time during at least the last five years and information regarding involvement in certain legal or administrative proceedings, if applicable. The biographies also reflect the Board committee memberships the nominees will hold upon their election. In addition, a Board Diversity Matrix can be found on page 18.17. We believe that each nominee possesses the core competencies that are expected of all of our directors, namely, independence (except for Mr. Stein and Ms. Palmer), integrity, sound business judgment and athe ability and willingness to represent the long-term interests of our shareholders.

SKILLS/EXPERIENCE |  |  |  |  |  |  |  |  |  |  |  |  | |||||||||||||||||||||

BUSINESS/STRATEGIC LEADERSHIP “C Suite” experience (CEO, CFO, COO or similar) or sub “C Suite” experience as division president or functional leader within a substantial organization. |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||

REAL ESTATE/REIT Experience in a significant organization where the ownership, operation and development of real estate is integral to the business; or knowledge and experience in issues facing real estate investment trusts. |   |   |   |  |  |   |   |   |   |   |   | ||||||||||||||||||||||

CAPITAL MARKETS/INVESTMENTS Experience in equity, debt and capital markets, generally. |  |  |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||

CONSUMER RETAIL Experience in a consumer driven or technology related retailer. |   |   |  |  |  |  |  | ||||||||||||||||||||||||||

CORPORATE GOVERNANCE/ Experience serving as a public company director (other than Regency Centers) and demonstrated understanding of corporate governance standards and practices in public companies. |  |  |  |  |  |  |  |  |  |  | |||||||||||||||||||||||

FINANCIAL/ACCOUNTING* Experience as a public company senior leader with significant financial responsibilities (e.g. CEO or CFO) or able to qualify as an Audit Committee Financial Expert under SEC rules. |   |   |  |   |   |   |   |   |   |   |   | ||||||||||||||||||||||

HUMAN CAPITAL Experience managing a large and diverse workforce with involvement in benefits, compensation and incentive planning, including Board and management succession planning. |  |  |  |  |  |  |  |  |  | ||||||||||||||||||||||||

TECHNOLOGY/CYBER Significant experience with or oversight of innovation, technology, information systems and data management. |  |   |   |   |  |  |  | ||||||||||||||||||||||||||

*All of our directors are “financially literate” as defined by SEC rules.

REGENCY CENTERS | 2022 2024 PROXY STATEMENT |9

| Proposal One: Election Of Directors

| Bryce Blair

Age: Director Since: 2014 |

Professional Experience:

Mr. Blair, a graduate of the University of New Hampshire, holds an M.B.A. from Harvard Business School. Mr. Blair serves as the principal of Harborview Associates, LLC, which holds and manages investments in various real estate properties. He serves as Chairmana director of PulteGroup, Inc., one of the largest home builders in the U.S., andin which he served as Chairman from 2017 until December 31, 2022. He is a member of the Advisory Board of Navitas Capital, a venture capital firm focused on technology for the real estate sector. Mr. Blair serves as the principal of Harborview Associates, LLC, which holds and manages investments in various real estate properties. Mr. Blair served as Chairman, from 2017 to 2021, and director, from 2013 to 2021, of Invitation Homes, Inc. He has served as Chairman, from 2002 to 2013, and Chief Executive Officer, from 2001 to 2012, of AvalonBay Communities, Inc., a real estate investment trust focused on the development, acquisition and management of multi-family apartments. Mr. Blair also serves on the Advisory Board of the Boston College Center for Real Estate and Urban Action and the Advisory Board of Home Start, a non-profit focused on ending homelessness in the greater Boston area. He previously served on the Advisory Board of the MIT Center for Real Estate. Prior to the formation of Avalon Properties in 1993, Mr. Blair was a partner with Trammell Crow Residential. Mr. Blair also previously served as senior advisor to McKinsey and Co. and previously served as a part time faculty member at Boston College. Mr. Blair is a past Chairman of the National Association of Real Estate Investment Trusts (“Nareit”)(Nareit), where he also served on the Executive Committee and the Board of Governors. He is a past member of ULIUrban Land Institute (ULI) where he served as a Trustee and was past Chairman of the Multi-Family Council. Mr. Blair is a past member of the Young Presidents Organization and a former member of the World Presidents Organization.

Board Committees ◾ Nominating and Governance ◾ Investment (Chair)

Other public company boards ◾ PulteGroup, Inc.

| |||

Principal occupation or employment ◾

Qualifications Extensive experience in real estate operations, development and investment. Strong background in corporate strategy and corporate governance.

| |||

| C. Ronald Blankenship Independent Lead Director

Age: Director Since: 2001 |

Professional Experience:

Mr. Blankenship, a graduate of the University of Texas, is a certified public accountant. Mr. Blankenship served as the President and Chief Executive Officer of Verde Realty infrom January 2009 and assumed the additional role of its Chairman from January 2012 to December 2012.2012 until August 2013. Prior to 2009, he served in various executive and director capacities at Security Capital Group and Archstone Communities Trust. While he was with Security Capital Group, it held controlling interests in eighteen public and private real estate operating companies, eight of which were listed on the NYSE. Prior to joining Security Capital, Mr. Blankenship was a regional partner at Trammell Crow Residential and was on the management Board for Trammell Crow Residential Services. Before Trammell Crow, Mr. Blankenship was the Chief Financial Officer and President of office development for Mischer Corporation, a Houston-based real estate development company. He serves as a director of Civeo Corporation, a provider of work-force accommodations. He formerly served as trustee of Prologis Trust and director of Archstone Communities Trust, BelmontCorp, InterPark Holdings Incorporated, Storage USA, Inc., CarrAmerica Realty Corporation and Macquarie Capital Partners, LLC. Mr. Blankenship serves as a director of Pacolet-Miliken Enterprises, Inc., a private investment company, Berkshire Residential Investments, a private real estate investment management company, and Merit Hill Holdings, LP, a privately held owner and operator of self-storage facilities. While he was with Security Capital Group, Security Capital Group had controlling interests in eighteen public and private real estate operating companies, eight of which were listed on the NYSE. Prior to joining Security Capital, Mr. Blankenship was a regional partner at Trammell Crow Residential and was on the management Board for Trammell Crow Residential Services. Before Trammell Crow, Mr. Blankenship was the Chief Financial Officer and President of office development for Mischer Corporation, a Houston-based real estate development company.

Board Committees ◾ Audit ◾ Investment

Other public company boards ◾ Civeo Corporation

| |||

Principal occupation or employment ◾ Former President and Chief Executive Officer of Verde Realty

Qualifications Extensive background in real estate development, acquisitions, financing and operations. Extensive experience in public company governance, the REIT industry, strategic planning, capital allocation, human capital management and executive compensation.

| |||

10| REGENCY CENTERS | 2022 2024 PROXY STATEMENT

Proposal One: Election Of Directors |

| Kristin A. Campbell Age: 62 Director Since: 2023 |

Professional Experience:

Ms. Campbell, a graduate of Arizona State University, holds a J.D. from Cornell Law School. She serves as Senior Advisor at BarkerGilmore, a national legal executive search and leadership consulting firm. She served as Executive Vice President, General Counsel and Chief ESG Officer of Hilton Worldwide Holdings Inc., a global hospitality company from June 2011 until her retirement in October 2023.She led Hilton’s global legal, compliance, government affairs and ESG functions. Prior to Hilton, Ms. Campbell was Senior Vice President, General Counsel and Corporate Secretary for Staples, Inc. from 2007 to 2011, with an overall tenure of 18 years at Staples. Prior to Staples, she worked at several law firms, including Goodwin Proctor and Rackemann, Sawyer & Brewster. Ms. Campbell has served as director of The ODP Corporation since 2016. She is a member of the Advisory Board of each of Boston University School of Hospitality Administration and LegalMation. Ms. Campbell serves on the board of Crete Mechanical Group, a private national multi-service building solution provider. She previously served on the Advisory Board of New Perimeter.

Board Committees ◾ Compensation ◾ Nominating and Governance Other public company boards ◾ The ODP Corporation | ||

Principal occupation or employment ◾ Recently Retired Executive Vice President, General Counsel and Chief ESG Officer of Hilton Worldwide Holdings Inc. Qualifications Extensive background in legal, compliance, ESG, retail, public company board and governance, real estate and M&A. | ||

| Deirdre J. Evens

Age: Director Since: 2018 |

Professional Experience:

Ms. Evens, a graduate of Cornell University, currently servesserved as Executive Vice President and General Manager, IT Asset Lifecycle Management of Iron Mountain.Mountain, Inc.from January 2022 until her retirement in December 2023. Prior to that, she served as Executive Vice President and General Manager, North America, Records and Information Management of Iron Mountain.Mountain from July 2018 to January 2022. Prior to that, she served as its Chief of Operations from January 2018 to June 30, 2018 and as its Chief People Officer and Executive Vice President from July 21, 2015 to January 2018. Prior to her service with Iron Mountain, Ms. Evens served as an Executive Vice President of human resources at Clean Harbors, Inc. from 2011 to July 2015, overseeing all aspects of human resources and employee development for a global workforce of more than 13,000 employees. From 2007 to 2011, Ms. Evens served as Executive Vice President of corporate salesCorporate Sales & marketingMarketing for Clean Harbors. Prior to her service with Clean Harbors, Ms. Evens served as Senior Vice President of member insightMember Insight at BJ’s Wholesale Club Holdings, Inc. from 2006 to 2007 and held a series of positions of increasing responsibility at Polaroid Corporation from 1986 to 2006, including her role as Senior Vice President of strategy.Strategy.

Board Committees ◾ Audit ◾ Compensation (Chair)

Other public company boards ◾ None

| |||

Principal occupation or employment ◾ Recently Retired Executive Vice President and General Manager, IT Asset Lifecycle Management of Iron Mountain

Qualifications

| |||

REGENCY CENTERS | 2024 PROXY STATEMENT |11

| Proposal One: Election Of Directors

| Thomas W. Furphy

Age: Director Since: 2019 |

Professional Experience:

Mr. Furphy, a graduate of Hartwick College, currently serves as Chief Executive Officer and Managing Director of Consumer Equity Partners, a venture capital and venture development firm. He also serves as Chairman and Chief Executive Officer of Replenium, Inc., a private e-commerce software company. PriorSince July 2023, Mr. Furphy has served as a Luminary (senior advisor) to Accenture, a Dublin company that specializes in information technology services and consulting. Previously, Mr. Furphy served as Vice President of Consumables and AmazonFresh at AmazonAmazon.com, Inc. from 2005 to 2009, where he was responsible for the underlying strategy, development and execution of the company’s grocery and health and beauty businesses. Prior to Amazon, Mr. Furphy was the founder and Chief Executive Officer of Notiva, a leading provider of web-based trade settlement software for retailers and their trading partners. Prior to Notiva, from 1991 to 1999, he held various senior management roles at Wegmans Food Markets.Markets, Inc. Mr. Furphy also servespreviously served as Chairman and Chief Executive Officer of Ideoclick, Inc., a full servicefull-service ecommerce private agency. He also previously served as a board member of BevyUp, a private digital retail-selling platform, which was acquired by Nordstrom in March 2018. He previously served as a board member of Fairway Group Holdings Corp., a private parent company of Fairway Market, a grocery store operator.

Board Committees ◾ Audit ◾

Other public company boards ◾ None

| |||

Principal occupation or employment ◾ Chief Executive Officer and Managing Director of Consumer Equity Partners

Qualifications Extensive experience in retail, addressing technological change, cyber issues, marketing, finance and leadership.

| |||

REGENCY CENTERS | 2022 PROXY STATEMENT |11

| Proposal One: Election Of Directors

| Karin M. Klein

Age: Director Since: 2019 |

Professional Experience:

Ms. Klein, a graduate of the University of Pennsylvania, holds an M.B.A from the Wharton School of University of Pennsylvania. She serves as the founding partner of Bloomberg Beta, a venture capital firm which invests in technology companies that help businesses work smarter, with a focus on machine intelligence, since 2013. Prior to launching Bloomberg Beta, Ms. Klein was responsible for strategy and business development for Bloomberg L.P. from 2010 to 2013 including serving as head of new initiatives. Prior to Bloomberg, from 2000 to 2010, Ms. Klein served in various roles at Softbank Corp., a multinational telecommunications and technology company, including the role of directorDirector of corporate development.Corporate Development. Before Softbank, she also held investing and operating roles at several investment companies and co-founded a children’s education business. She serves as a director of Paramount Group, Inc., and formerly served as a member of the Board of Trustees of Harvey Mudd College.

Board Committees ◾ Audit (Chair) ◾ Nominating and Governance

Other public company boards ◾ Paramount Group, Inc.

| |||

Principal occupation or employment ◾ Founding Partner of Bloomberg Beta

Qualifications Extensive experience in media, addressing technological change, cyber issues, investments, finance, accounting, strategy and leadership.

| |||

12| REGENCY CENTERS | 2024 PROXY STATEMENT

Proposal One: Election Of Directors |

| Peter D. Linneman

Age: Director Since: 2017 |

Professional Experience:

Dr. Linneman holds both an M.A. and a doctorate degree in economics from the University of Chicago. He served on the Board of Equity One, Inc. from 2000 until its merger with usRegency in 2017. Dr. Linneman is currently a principal of Linneman Associates, a real estate advisory firm, and affiliated entities. From 1979 to 2011, Dr. Linneman was a Professor of Real Estate, Finance and Public Policy at the University of Pennsylvania, Wharton School of BusinessUniversity of Pennsylvania and is currently an Emeritus Albert Sussman Professor of Real Estate. He serves as an independent director of AG Mortgage Investment Trust, Inc., Paramount Group, Inc., and Equity Commonwealth. Dr. Linneman served as a director of Bedford Property Investors, Inc., Atrium European Real Estate Ltd. and JER Investors Trust, Inc., a finance company that acquires real estate debt securities and loans. He was also Chairman of Rockefeller Center Properties.Properties Inc.

Board Committees ◾ Audit ◾ Nominating and Governance

Other public company boards ◾ AG Mortgage Investment Trust, Inc. ◾ Paramount Group, Inc. ◾ Equity Commonwealth

| |||

Principal occupation or employment ◾ Principal of Linneman Associates and affiliated entities

Qualifications Extensive experience in financial and business advisory services and investment

| |||

12| REGENCY CENTERS | 2022 PROXY STATEMENT

Proposal One: Election Of Directors |

| David P. O’Connor

Age: Director Since: 2011 |

Professional Experience:

Mr. O’Connor, a graduate of the Carroll School of Management at Boston College, holds an M.S. degree in real estate from New York University. Mr. O’Connor serves as managing partner of High Rise Capital Partners, LLC and non-executive Co-Chairman of HighBrook Investment Management, LP, a real estate private equity firm. He was the co-founder and senior managing partner of High Rise Capital Management, L.P., a real estate securities hedge fund manager which managed several funds from 2001 to 2011. Mr. O’Connor serves as director of Prologis, Inc., a global leader in industrial real estate, and served as director of Paramount Group, Inc., an owner-operator and manager of high-quality office properties from November 2014 to June 2018. From 1994 to 2000, he was principal, co-portfolio manager and Investment Committee member of European Investors, Inc., a large dedicated REIT investor. He serves on the Board of Trustees of Boston College, the Investment Committees of endowments for Boston College and Columbia University (Teacher’s College) and serves on the Executive Committee of the Zell/Lurie Real Estate Center at the Wharton School of University of Pennsylvania’s Wharton School.Pennsylvania. Mr. O’Connor also serves as a national trustee of PGA REACH, the charitable foundation of the PGA of America. He is a frequent speaker at REIT investment forums and conferences and has served as an adjunct instructor of real estate at New York University.

Board Committees ◾ Compensation ◾ Nominating and Governance (Chair)

Other public company boards ◾ Prologis, Inc.

| |||

Principal occupation or employment ◾ Managing Partner of High Rise Capital Partners, LLC and Non-Executive Co-Chairman of HighBrook Investment Management, LP

Qualifications Extensive experience as a successful real estate securities investor, as well as hedge fund manager. Strong background and experience in real estate securities and capital markets.

| |||

REGENCY CENTERS | 2024 PROXY STATEMENT |13

| Proposal One: Election Of Directors

| Lisa Palmer

Age: Director Since: 2018 |

Professional Experience:

Ms. Palmer, a graduate of the University of Virginia, holds an M.B.A. from the Wharton School of the University of Pennsylvania. Ms. Palmer became our Chief Executive Officer on January 1, 2020, and has served as our President since January 1, 2016 to date. Previously, she served as our Chief Financial Officer from January 2013 to August 12, 2019. Prior to that, she served as Senior Vice President of capital marketsCapital Markets from 2003 until 2013. She served as senior managerSenior Manager of investment servicesInvestment Services in 1996 and assumed the role of Vice President of capital marketsCapital Markets in 1999. Prior to joining our Company, Ms. Palmer worked with Accenture plc, formerly Andersen Consulting Strategic Services, as a consultant and financial analyst for General Electric.Electric Company. She serves as a director of the Jacksonville Branch of the Federal Reserve Bank of Atlanta and Brooks Rehabilitation, a private healthcare organization. She is also a board membercurrently serves as Chair of United Way of Northeast Florida, an executive board member of Nareit, a member of ULI, and a member of the International CouncilBoard of Shopping Centers (“ICSC”)Trustee of Innovating Commerce Serving Communities (ICSC). She previously served as a director of ESH Hospitality, Inc., a subsidiary of Extended Stay America, Inc.

Board Committees ◾ Investment

Other public company boards ◾ None

| |||

Principal occupation or employment ◾ Our Chief Executive Officer since January 1, 2020 and President since January 1, 2016

Qualifications Extensive knowledge of the shopping center and real estate industries along with finance and capital markets, operations, public board strategy and governance.

| |||

REGENCY CENTERS | 2022 PROXY STATEMENT |13

| Proposal One: Election Of Directors

| James H. Simmons, III

Age: Director Since: 2021 |

Professional Experience:

Mr. Simmons, a graduate of Princeton University, holds an M.S. from Virginia Tech and an M.B.A. from Northwestern University. Mr. Simmons currently serves as Chief Executive Officer and Founding Partner of Asland Capital Partners, an institutional investment management platform, serving as head of the investment committee with responsibility for the strategic direction and investment strategy of the firm. Prior to Asland, Mr. Simmons served as a Partner at Ares Management Corporation, a global alternative investment manager, from 2013 to 2018. He also served as a Partner at Apollo Real Estate Advisors L.P. from 2002 to 2013. Prior to Apollo, Mr. Simmons served as Chief Executive Officer and Chief Investment Officer of the Upper Manhattan Empowerment Zone Development Corporation. He also haspreviously served as a director of Apollo Strategic Growth Capital (NYSE: APSG) since 2020, and. He is currently serves asa member of Princeton University National Annual Giving Committee, a member of the Princeton University President’s Advisory Council, vice-chair of the Real Estate Executive Council, and as a director of the Greater Jamaica Development Corporation.

Board Committees ◾ Compensation ◾ Investment

Other public company boards ◾

| |||

Principal occupation or employment ◾ Chief Executive Officer and Founding Partner of Asland Capital Partners

Qualifications Extensive knowledge of and experience in real estate development, transactions and operations. Strong experience in finance, marketing, strategy and leadership.

| |||

14| REGENCY CENTERS | 2024 PROXY STATEMENT

Proposal One: Election Of Directors |

| Martin E. Stein, Jr. Executive Chairman

Age: Director Since: 1993 |

Professional Experience:

Mr. Stein, a graduate of Washington and Lee University, holds an M.B.A. from Dartmouth College’s Tuck School of Business. Mr. Stein has been our Executive Chairman of the Board since January 1, 2020, having served as a director of the Board since 1993 and its Chairman since 1998. Mr. Stein served as Chief Executive Officer from our initial public offering in 1993 until December 31, 2019. He was our President and Chief Executive Officer from 1993 until 1998 and presidentPresident of our predecessor real estate division beginning in 1981 and Vice President from 1976 to 1981. He is a director of FRP Holdings, Inc., a publicly held real estate company. He served as past Chairman of Nareit, and is a member of ULI, ICSC and the Real Estate Roundtable. Mr. Stein is a former trustee of Washington and Lee University and ULI.

Board Committees ◾ Investment

Other public company boards ◾ FRP Holdings, Inc.

| |||

Principal occupation or employment ◾

Qualifications Extensive experience in real estate development, acquisitions, financing and operations. Strong knowledge of the REIT industry, strategic planning, capital allocation, people management and executive compensation.

| |||

14| REGENCY CENTERS | 2022 PROXY STATEMENT

Proposal One: Election Of Directors |

|

|

Professional Experience:

Mr. Wattles, a graduate of Stanford University, holds an M.B.A. from the Stanford Graduate School of Business. He consults for a private equity firm that specializes in real estate. Mr. Wattles serves as a director of Advance Real Estate, a privately held industrial real estate company in Mexico City and Delin Property, a European industrial real estate company. Mr. Wattles served as a director of Columbia Property Trust from 2013 to 2021. Mr. Wattles served as Executive Chairman of DCT Industrial Trust, a publicly held industrial property REIT, from 2003 to May 2016, and then served as Chairman Emeritus from May 2016 to August 2018. Mr. Wattles was a principal of both Black Creek Group and Dividend Capital Group LLC, each a real estate investment management firm, from 2003 to 2008. He served as Chief Investment Officer of Security Capital Group from 1997 to 2002. Mr. Wattles was managing director, then Co-Chairman and Chief Investment Officer of ProLogis, Inc. from 1992 to 1997. Mr. Wattles has previously served as a director of Prologis, Inc., Interpark Holdings Incorporated and Security Capital European Realty. At Security Capital Group, he oversaw capital deployment and investments in multiple public and private operating platforms with focus on retail, industrial, parking, manufactured housing and European office sectors. While Mr. Wattles was with Security Capital Group, Security Capital Group had controlling interests in eighteen public and private real estate operating companies, eight of which were listed on the NYSE.

| ||

| ||

REGENCY CENTERS | 2022 2024 PROXY STATEMENT |15

| Corporate Governance

Corporate Governance Guidelines

Our Board has adopted a set of Corporate Governance Guidelines (“CGGs”)(CGGs), which describe the Board’s responsibility for oversight of the business and affairs of the Company as well as guidelines for determining director independence and consideration of potential nominees to the Board. Our CGGs are found on the Company’s website at www.regencycenters.com.https://investors.regencycenters.com. Our Board, directly and through its Nominating and Governance Committee, regularly reviews developments and best practices in corporate governance and makes modification to the CGGs, committee charters and other key governance documents, policies and practices as it determines necessary or desirable.appropriate.

Our Board of Directors has determined that nine of its eleven nominated directorsnominees for director (Bryce Blair, C. Ronald Blankenship, Kristin A. Campbell, Deirdre J. Evens, Thomas W. Furphy, Karin M. Klein, Peter D. Linneman, David P. O’Connor, and James H. Simmons, III and Thomas G. Wattles)III), or 82%, are “independent” as defined by applicable Nasdaq Stock Market listing standards.requirements. The Board annually reviews all commercial, familial and charitable relationships of directors and determines whether directors meet these applicable independence tests. To assist in making these determinations, the Board has adopted a set of independence standards, which are set forth in the Company’s CGGs, which meet or exceed the Nasdaq Stock Market listing standards.requirements.

The roles of Executive Chairman of the Board and Chief Executive Officer are currently separate. Our Board does not have a formal policy on whether the same person should serve in both roles at the same time and believes that it shouldis prudent to have the flexibility to periodically review and determine the leadership structure that it believes is in the best interest of the Company and its shareholders.

Since January 1, 2020, Mr. Stein has served as Executive Chairman of the Board given his extensive history with the Company and vast knowledge of the real estate industry. Ms. Palmer serves as Chief Executive Officer and as a member of the Board. Pursuant to the CGGs, if the Chairman is also an employee of the Company (as Mr. Stein is, as Executive Chairman), the Board shall elect an independent Lead Director. Mr. Blankenship was appointedfirst elected Lead Director in 2019.2019 and has been re-elected unanimously by the Board each year since then.

Role of Independent Lead Director

The independent Lead Director serves as the principal liaison between the Executive Chairman of the Board and the independent directors, presides at the executive sessions of independent directors at each Board meeting and other meetings of independent directors, helps lead the annual performance evaluation of the Executive Chairman and the Chief Executive Officer, and performs such other duties as may be assigned or requested by the Board. Both the Executive Chairman and the Chief Executive Officer consult routinely with the independent Lead Director on board agendas, substantive board issues and on strategic and significant business issues facing the Company.

See “Shareholder Proposals and Communications with the Board of Directors” for information on how to communicate with Mr. Blankenship or any of the other independent directors. |

|

16| REGENCY CENTERS | 2022 2024 PROXY STATEMENT

Corporate Governance |

Meetings of Board of Directors

Our Board held five regular meetings during 2023. All directors attended at least 75% of all meetings of the Board and Board committees on which they served during 2023.

|

|

Directors are encouraged to attend each Annual Meeting of Shareholders. However, we do not have a formal policy requiring their attendance. Each of our current directors (who comprise all of the current nominees) were present during the 2023 Annual Meeting.

Executive Sessions of Independent Directors

The independent directors hold regularly scheduled executive sessions of the Board and its committees without senior management (noror the non-independent directors) directors present. These executive sessions are chaired by the independent Lead Director (at Board meetings) or by the committee chairs (at committee meetings), alleach of whom are independent directors. The independent directors met in executive session at all of the regularly scheduled Board and committee meetings held in 2021.2023.

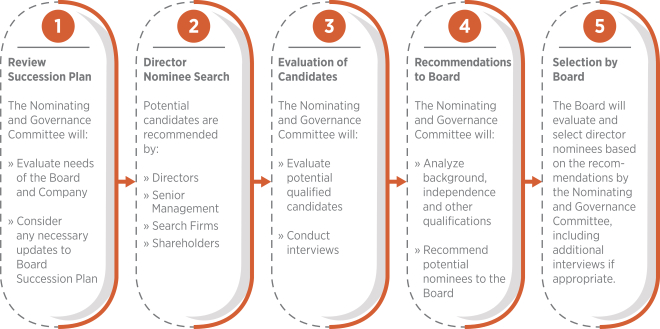

The Nominating and Governance Committee assists the Board of Directors in establishing criteria and qualifications for potential Board members. The committee identifies individuals who meet such criteria and qualifications to become Board members and recommends to the Board such individuals as potential nominees for election to the Board.

In addition, after consideration of the skills matrix set forth on page 9, diversity matrix on page 18below and other considerations in respect of the potential needs of the Board, the committee seeks competencies, attributes, skills and experience that will complement and enhance the Board’s existing make-up, while taking into account expected retirements, to best facilitate Board succession, transition and effectiveness. The committee evaluates each individual in the context of the Board as a whole, to recommend a group that can best continuecontribute to the success of our Company.

Directors may not be nominated or stand for re-election after reaching age 75, unless the Board elects to waive this limitation.

Board Diversity Matrix (as of March 20, 2024)*

The table below reflects certain diversity information based on self-identification by each director.

Board Size: | ||||||||

Total Number of Directors | 11 | |||||||

Gender: | Female | Male | Non-Binary | Did not Disclose | ||||

Number of directors based on gender identity | 4 | 6 | 0 | 1 | ||||

Demographic Background: | ||||||||

African American or Black | 0 | 1 | 0 | 0 | ||||

Alaskan Native or American Indian | 0 | 0 | 0 | 0 | ||||

Asian | 0 | 0 | 0 | 0 | ||||

Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

White | 4 | 5 | 0 | 0 | ||||

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

LGBTQ+ | 0 | |||||||

Did Not Disclose Demographic Background | 1 | |||||||

* To see our Board’s diversity matrix as of March 22, 2023, please see our proxy statement filed with the SEC on March 22, 2023.

REGENCY CENTERS | 2024 PROXY STATEMENT |17

| Corporate Governance

Succession Planning, Board Refreshment and Diversity

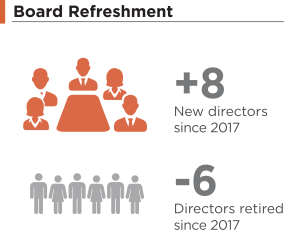

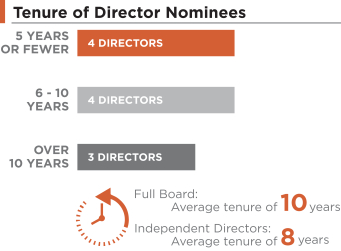

The mix of skills, experiences, backgrounds, tenures and competencies, as well as the continuity of our Board, hashave been integral over time to the success of our Company. To ensure that this mix is maintained and enhanced, our Board has established a succession planning process. After initially adopting a formal succession plan in 2014, this plan has since been revisited and revised multiple times by the Board. A review of the Board succession plan is part of the annual agendaagendas of both the Nominating and Governance Committee and the full Board.

Our Nominating and Governance Committee evaluates the specific personal and professional attributes of each director candidate versus those of existing Board members to ensure diversity of competencies, experience, personal history and background, thought, skills and expertise across the full Board. While our Nominating and Governance Committee has not adopted a formal diversity policy in connection with the evaluation of director candidates or the selection of nominees, active and intentional consideration is also given to diversity in terms of gender, ethnic background, age and other similar attributes that could contribute to Board perspective and effectiveness. Our Board currently has threefour female directors (36%), and in 2021, theone ethnically diverse director, for an aggregate representation of diversity on our Board appointed James H. Simmons, III to our Board. In addition to his extensive qualifications and experience in the real estate industry, Mr. Simmons brings ethnic diversity to the Board.of approximately 45%.

The committeeNominating and Governance Committee also continually assesses diversity through its annual succession plan review, annual evaluation of Board structure and composition, and annual Board and committee performance self-assessment process. The committee and the Board believe that fostering Board diversity best serves the needs of the Company and the interests of its shareholders, and it is one of the key factors considered when identifying individuals for Board membership. We believe that diversity with respect to competencies, thought, gender, ethnicity, tenure, experience and expertise is important to provide both fresh perspectives and deep experience and knowledge of the Company.

REGENCY CENTERS | 2022 PROXY STATEMENT |17

| Corporate Governance

Over the past several years, the Board has significantly refreshed itself, reflecting a balanced and diverse group of skilled, experienced directors with varied perspectives and backgrounds, as reflected on the skills matrix, diversity matrix and nominee biographies. The Board’s 2021 succession plan reflects the same objectives. Accomplishments of the Board’s succession planning process since 2015 include:

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Board Diversity Matrix (as of March 18, 2022)

Board Size: | ||||||||

Total Number of Directors | 12 | |||||||

Gender: | Female | Male | Non-Binary | Gender Undisclosed | ||||

Number of directors based on gender identity | 3 | 8 | 0 | 1 | ||||

Demographic Background: | ||||||||

African American or Black | 0 | 1 | 0 | 0 | ||||

Alaskan Native or American Indian | 0 | 0 | 0 | 0 | ||||

Asian | 0 | 0 | 0 | 0 | ||||

Hispanic or Latinx | 0 | 0 | 0 | 0 | ||||

Native Hawaiian or Pacific Islander | 0 | 0 | 0 | 0 | ||||

White | 3 | 7 | 0 | 0 | ||||

Two or More Races or Ethnicities | 0 | 0 | 0 | 0 | ||||

LGBTQ+ | 0 | |||||||

Did Not Disclose Demographic Background | 1 | |||||||

18| REGENCY CENTERS | 2022 PROXY STATEMENT

Corporate Governance |

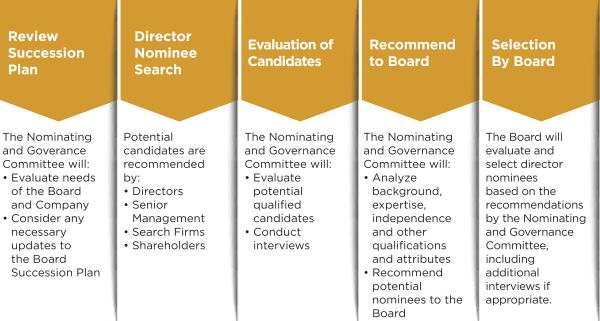

Director Nominee Selection Process

Our Nominating and Governance Committee solicits input regarding potential candidates from a variety of sources, including existing directors, senior management and shareholders. From time to time, we have used an executive search firm, especially when helpful in identifying new or different pools of talent for our Board. For example, in 2021, theour Board engaged an executive search firm in each of 2021 and 2022 to assist usour Company in the successful recruitment of atwo highly experienced ethnicallyand diverse candidatecandidates for our Board, which led to the appointment of Mr. Simmons.Simmons and Ms. Campbell, respectively. Through these and other means, the Board has continually refreshed itself by selecting directors who will be additive to the overall mix of talent, experience and expertise on the Board. The committee evaluates potential candidates based on a variety of factors and also arranges personal interviews by one or more committee members, other Board members and senior management, where appropriate.

18| REGENCY CENTERS | 2024 PROXY STATEMENT

Corporate Governance |

Director Candidate Nominations through Proxy Access

Our bylaws make proxy access available to our shareholders. Under this process, a shareholder or group of up to 20 shareholders of common stock who have owned shares of our common stock equal to at least 3% of the aggregate of our issued and outstanding common shares continuously for at least three years may seek to include director nominees in our proxy materials at our Annual Meeting. The maximum number of director nominees that may be submitted pursuant to these provisions may not exceed 25% of the number of directors then on the Board, with such number willto be reduced by the number of individuals that the Board nominates for re-election who were previously elected based upon a nomination pursuant to proxy access or other shareholder nomination or proposal. To be eligible to use proxy access, such shareholders must satisfy other eligibility, procedure and disclosure requirements set forth in our bylaws.

REGENCY CENTERS | 2022 PROXY STATEMENT |19

| Corporate Governance

Our Board does not allow “overboarding”, which refers to a director serving on an excessive number of public company boards. Excessive board commitments can lead to a director being unable to devote sufficient attention to Board matters and appropriately fulfill his or her duties to the Company and its shareholders. Our CGGs limit the number of boards on which our directors and officers can serve, and further provide that no more than two active Regency executives may serve on our Board at any time. Our CGGs provide for the following limitations:

Position | Maximum Public | ||||||

Independent director holding full-time executive position with another company | 2 | ||||||

Independent director who is not a full-time executive | 4 | ||||||

Regency officer | 2** | ||||||

* Maximum number includes service on Regency’s Board.

** Notwithstanding anything to the contrary in our CGGs, no Regency officer may serve on more than one outside public company Board unless a specific exception is made by the Board.

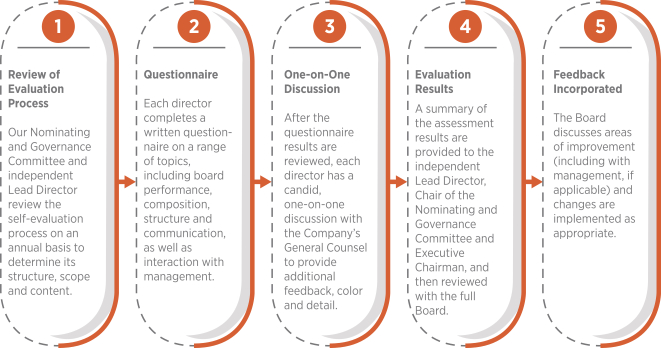

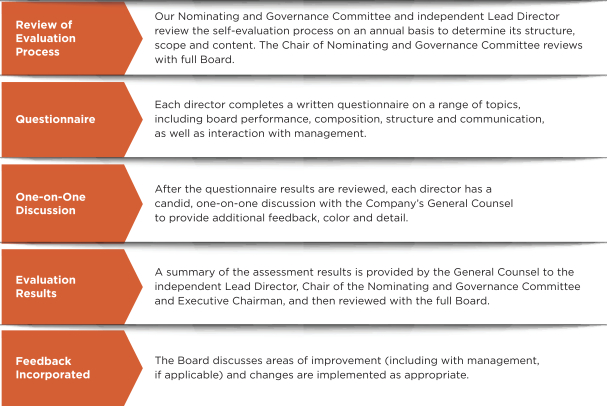

Board Self-Assessment and Evaluation

Annual self-evaluation and assessment of Board performance helps ensure that theour Board and its committees function effectively and in the best interest of our shareholders. This process also promotes good governance and helps set expectations about the relationship and interaction of and between theour Board and management. TheOur Board’s annual self-evaluation and assessment process, which is overseen by our independent Lead Director and Chair of our Nominating and Governance Committee, is re-evaluatedreviewed and reconsidered annually and is currently structured and carried out as follows:

20|REGENCY CENTERS | 2022 2024 PROXY STATEMENT|19

|Corporate Governance|

Our Board actively oversees material risks that could impact the Company. This oversight is conducted both directly by management and through committees of the Board. TheBoard committees. Our Board satisfies its responsibility through receiving reports by each committee chair after each meeting regarding the applicable committee’s considerations and actions, as well as through regular reports directly from officers and management level committees responsible for oversight of particular risks within the Company. Management committees frequently work jointly on issues with overlapping subject matter.

|

Oversees the Company’s most significant risks and ensures that management

|

Board Committees

AUDIT

|

COMPENSATION

|

NOMINATING AND

|

INVESTMENT

| |||||||||

◾ Has primary responsibility for overseeing financial statements integrity and financial risk for the Company.

◾ Oversees cybersecurity risk. | ◾ Oversees risk associated with our executive compensation programs, policies and practices. | ◾ Oversees

◾ Oversees

◾ Oversees

◾ Oversees

| ◾ Oversees risks associated with capital allocation.

◾ Oversees risks associated with real estate investments, developments and redevelopments. |

Management Committees

|

◾ Currently consists of our

◾

◾ Provides quarterly updates to the full Board and/or appropriate Board committee, either directly or through its management committees, concerning the strategic, operational and emerging risks to the Company’s ability to achieve its

|

|

|

| ||||||||||||||

Oversees real estate portfolio and investment risk. | Oversees corporate enterprise and operational risk. |

| BUSINESS CONTINUITY | CORPORATE RESPONSIBILITY

| CYBER RISK | COMPLIANCE |

DISCLOSURE

| ||||||||||||

Develops and executes strategies

| Assesses ESG-related risks and leads the initiatives of the Company’s corporate responsibility program. | Assesses and mitigates the risks posed by cybersecurity incidents and cyber-attacks impacting the Company’s data and information systems. | Oversees risk associated with the Company’s ethics and compliance program. | Assesses and mitigates risk associated with the Company’s financial controls and disclosures. |

20|REGENCY CENTERS | 2022 2024 PROXY STATEMENT|21

|Corporate Governance|

Our Board of Directors has established four standing committees: an Audit Committee, a Compensation Committee, a Nominating and Governance Committee and an Investment Committee, each as described below. Members of these committees are elected annually by our Board of Directors. The charters for each of these committees isare available on our website at www.regencycenters.com.

Audit Committee

| MEMBERS | KEY RESPONSIBILITIES | |||||||||

C. Ronald Blankenship*

Deirdre J. Evens*

Thomas

Peter D. Linneman*

The Board has determined that each member of the Audit Committee is independent as defined under the applicable

|

◾ Assists the Board in its oversight of: ◾ the integrity of our financial statements ◾ our accounting and reporting processes and controls ◾ REIT and other tax compliance ◾ derivatives and hedging transactions ◾ our internal audit functions, and ◾ our insurance programs

◾ Reviews the independence and performance of our

◾

◾ Approves the Audit Committee Report as shown on page 51. The report further details the Audit Committee’s responsibilities, and ◾ Oversees the Company’s cybersecurity program and initiatives (see below)

| |||||||||

| ||||||||||

The committee met |

Cybersecurity Governance Highlights

| |||||||||

* Audit Committee Financial Experts: Our Board has determined that each member of the Audit Committee qualifies as an “Audit Committee financial expert” as defined by the rules of the SEC. In accordance with our CGGs, no member of the Audit Committee serves on the Audit Committee of more than three public companies. | ✓ Management’s Cyber Risk Committee reports to the Board’s Audit Committee quarterly, including reports on any significant cyber breaches (no such breach in the past five years) ✓ References NIST cybersecurity framework to identify and remediate risk gaps ✓ Robust monitoring of internal and external threats ✓ Validation and testing, including third-party cyber assessments and penetration tests ✓ Review the security protocols of our key vendors ✓ Cyber insurance procured by the Company ✓ Preparation of Cybersecurity Risk Management Policy; modified in 2023 to reflect new SEC requirements | |||||||||

| ||||||||||

Compensation Committee

MEMBERS

|

KEY RESPONSIBILITIES

| |||||

Deirdre J. Evens, CHAIR

David P. O’Connor

James H. Simmons, III

The Board has determined that each member of the Compensation Committee is independent

|

◾ Establishes and oversees our executive compensation and benefits programs

◾

◾

◾

◾ | |||||

The committee met

| Note: The committee has retained

| |||||

| ||||||

22|

REGENCY CENTERS | 2022 2024 PROXY STATEMENT|21

|Corporate Governance|

Nominating and Governance Committee

MEMBERS

|

KEY RESPONSIBILITIES

| |||||

David P. O’Connor,

Bryce Blair Kristin A. Campbell

Karin M. Klein

Peter D. Linneman

The Board has determined that each member of the Nominating and Governance Committee is independent within the meaning of the Company’s independence standards and applicable listing standards of the Nasdaq Stock Market.

|

◾ Establishes sound corporate governance in compliance with applicable regulatory requirements and best practices

◾ Oversees the Company’s

◾ Assists our Board in establishing criteria and qualifications for potential Board members

◾ Identifies and recruits high quality individuals to become members of our Board and recommends director nominees to the Board

◾ Leads the Board in its annual assessment of the Board’s performance

◾ Reviews committee membership and recommends nominees for each committee of the Board

◾ Oversees the Company’s ethics and compliance program, and

◾ Oversees the Company’s political activities, including any political spending | |||||

The committee met

| ||||||

| ||||||

Investment Committee

MEMBERS

|

KEY RESPONSIBILITIES

| |||||

Bryce Blair,

C. Ronald Blankenship Thomas W. Furphy

Lisa Palmer

James H. Simmons, III

Martin E. Stein, Jr.

|

◾ Oversees and approves strategy relating to capital allocation and investment for acquisitions, redevelopments and new developments

◾ Approves investment guidelines for management, as well as any changes to such guidelines

◾ Oversees acquisition and disposition strategy and programs, and

◾ Reviews the financial performance of developments, redevelopments and other similar investments | |||||

The committee met

| ||||||

| ||||||

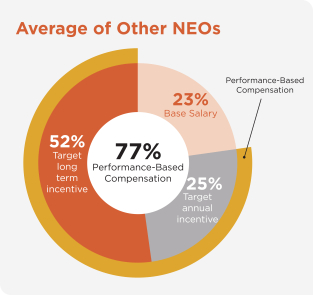

* This Director will assume the role of Chair after the Annual Meeting, assuming re-election to the Board.